Whose money is invested in the Sahara?

I have been following Sahara Group for the last 20 years. Still, I could never understand the functioning of the group properly. After following all the cases, I understood that Sahara works to extort money from people. It took many years for RBI and SEBI to stop the collection. The situation was never clear as to what happened to that money. The government had told Parliament last year that Rs 1 lakh crore belonging to 13 crore people is stuck in the Sahara. Now the government has done a good job. Cooperation Minister Amit Shah launched the Sahara Refund Portal. Through this fund, Rs 5,000 crore will be returned to ten crore people.

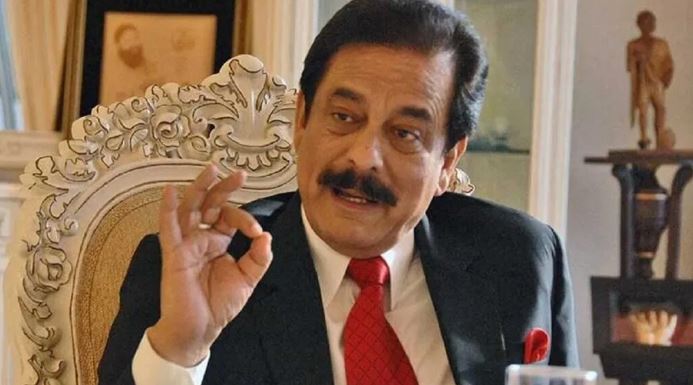

Bollywood used to dance to the tune of Sahara Shree

Sahara Group chief Subrata Roy used to call himself a managing worker. Sahara Shree appeared before his name. Sahara employees have been greeting each other with Sahara Pranam. Everyone also had to wear a uniform. Roy started business in 1978 from Gorakhpur, Uttar Pradesh. Vegetable vendors and rickshaw pullers were not able to open bank accounts. Sahara agents used to take money from them every day. Even one rupee was taken as a deposit. Within 10-15 years, Sahara’s work spread across the country. Newspapers came out, TV channels opened, airlines, hotels, etc. Sahara’s business started spreading everywhere. The Indian cricket team used to wear Sahara jerseys. Bollywood used to dance to the tune of Sahara Shree.

Sahara worked on the license of RNBC i.e. Residul Non Banking Company. Kolkata’s Peerless also worked in the same sector. These companies had more exemptions than NBFC i.e. non-banking companies. There was no limit on how much deposit they could deposit. The only condition was that out of every Rs 100, 80 rupees had to be invested in government bonds so that the deposits remained safe. The company could have spent the remaining Rs 20 wherever it wanted. Sahara Group was accused of using 20% of the deposits for shady business. The Reserve Bank closed this source. Sahara was told that the entire Rs 100 of the deposit would have to be invested in government bonds. In 2008, the Reserve Bank banned Sahara from taking new deposits and asked it to close all business by 2015.

Sahara deposited Rs 15 thousand crores in the SEBI fund

Sahara looked for other ways to raise money and got stuck here. To raise money in the stock market, any company has to get permission from SEBI. Sahara bypassed him and collected Rs 25 thousand crores from the market. SEBI reached the Supreme Court. The court asked Sahara to return the money to the investors. Sahara Shree was sent to jail in a contempt case. Sahara deposited Rs 15 thousand crores in the SEBI fund. SEBI kept appealing to the people but in the last seven-eight years, 75 thousand people withdrew Rs 138 crore. The remaining amount was lying there. The Cooperative Ministry went to the Supreme Court and said that if five thousand crore rupees were given from this fund, then we would return the money of the people in the cooperative society. The court agreed and now the work of returning this money has started.

The central government told the Parliament last year that Sahara has 13 crore customers. Their Rs 1 lakh crore is stuck, out of which Rs 47 thousand crore is invested in cooperative societies. Sahara had deposited this money by opening cooperative societies in different states. Rs 19 thousand crores are stuck in Sahara real estate. In return for all this, Sahara has so far deposited Rs 15 thousand crores. If government figures are to be believed, Rs 85 thousand crores are outstanding. Now only five thousand crore rupees have to be paid.

The most surprising thing in the case of Sahara is that no one ever came forward to take the deposit. Due to this, questions are being raised as to whose money is it. Who are those people who do not come to ask for their money? Cooperative Minister Amit Shah said that so far five lakh people have come to the Sahara Refund Portal. Just imagine, the total number of depositors is 10 crores. Let’s see when the others come forward.

Note: Credit: Milind Khandekar Linkdin post.