Donald Ducks

New Delhi: Vanijya Bhawan, situated adjacent to India Gate and surrounded by verdant trees with a sweeping view of Lutyens’ Delhi, is the headquarters of the Union Ministry of Commerce and Industry. Recently, it has been bustling with activity as officials engage in trade negotiations with more than ten countries, including the United States.

This comes in the wake of US President Donald Trump’s announcement of ‘reciprocal’ tariffs affecting most nations. Although currently on hold, this situation necessitates a thorough examination of India’s foreign trade landscape and a well-considered policy response.

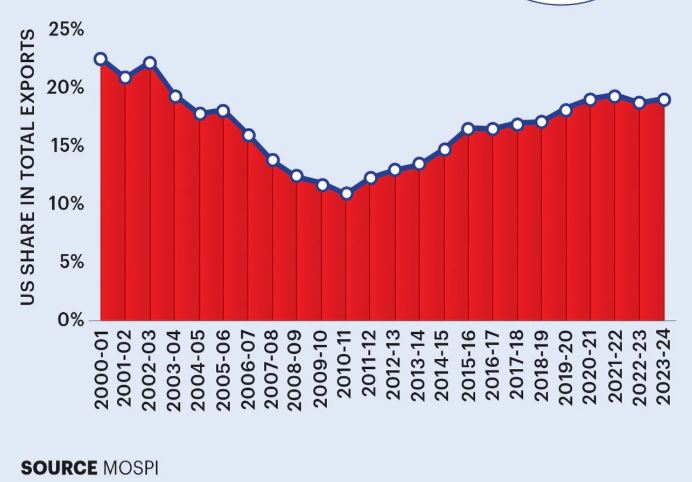

Exports were identified as one of the four primary drivers of the Indian economy by Finance Minister Nirmala Sitharaman in the Budget for 2025-26, but trade dynamics have now emerged as the foremost concern for New Delhi, given the increasingly unpredictable global environment and the new factors introducing fresh volatility almost daily.

The tariffs, which Trump announced on April 2 and subsequently suspended for 90 days on April 9, could potentially lead to a recession in the US once implemented, severely impact global trade and economic growth prospects, and create challenges even for economies like India that are bolstered by strong domestic demand. For India, trade and exports are becoming increasingly vital to its economic framework.

The nation aims to achieve $2 trillion in exports by 2030, with a target of $1 trillion each for merchandise and services exports, as it seeks to establish itself as a global manufacturing center. Currently, the proportion of goods exports stands at only 12% of GDP, compared to 20% for China. In recent months, India’s commerce ministry, under the leadership of Minister Piyush Goyal, has been actively pursuing a series of negotiations for free trade agreements (FTAs) with various countries.

This year, negotiations with the UK and New Zealand have been revitalized with enthusiasm, while the minister aims to finalize at least one agreement with the European Union within the year. Presently, India has FTAs with 13 countries, including the UAE, and an interim agreement with Australia.

The urgency arose following Trump’s return to the White House, where he promoted a protectionist agenda centered on the slogan ‘Making America Great Again.’ Since taking office as the 47th President of the United States in January, Trump has implemented a series of tariff increases on various goods and countries, culminating in the announcement of reciprocal tariffs affecting nearly 60 nations, which included a ‘discounted’ 26% tariff on imports from India.

Although tariffs on most countries are currently suspended, Trump’s actions have undeniably sparked a new global trade conflict, leading to retaliatory tariffs from the EU and China against the US. Anup Wadhawan, former commerce secretary of India, indicated that the US was likely to pause these tariffs due to pressure from American businesses and consumers, who would face severe consequences.

India, along with other nations, would now be subject to a 10% tariff, and negotiations could provide an opportunity for its removal. Wadhawan expressed confidence that this pause would extend beyond 90 days while discussions continue, potentially resulting in the elimination of the 10% tariff in exchange for mutual concessions. The US may also grant exemptions to China on a case-by-case basis, influenced by the demands of American industries, ultimately seeking a resolution that includes some concessions. Over time, even a 10% tariff could raise costs and diminish US competitiveness.

The strategy of exempting certain countries from high tariffs appears to be an attempt to prevent international isolation while maintaining a tough stance, but with domestic inflation concerns and strained international relations, this approach risks adversely affecting American consumers and businesses more than intended. The industry has expressed concerns that shipments of goods to the US may not only become pricier but could also face a halt in orders.

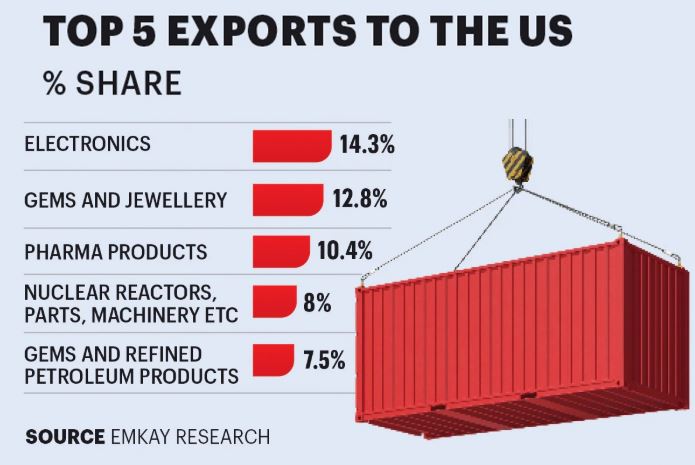

The United States continues to be a crucial export market for India, serving as its largest trading partner with exports totaling $68.46 billion from April 2024 to January 2025, accounting for approximately 19% of India’s overall exports. Major export categories include electronics, gems and jewelry, pharmaceuticals, auto parts, and textiles. Currently, the government is optimistic that the ongoing discussions regarding the bilateral trade agreement (BTA) with the US, with the initial phase expected to conclude by September or October, will ultimately provide India with relief from reciprocal tariffs.

Officials emphasize the importance of patience rather than impulsive actions. A senior official stated, ‘India is not seeking to respond with tariff measures like the EU and China; however, domestic interests in sectors such as agriculture and dairy will be protected within the BTA.’

India’s approach appears to focus on successfully negotiating the BTA with reductions on several items of interest to the US in the initial phase, enhancing trade relations with other nations, controlling the influx of goods from countries like China that could disrupt the domestic market, and providing necessary support to exporters.

There are signs that a new export promotion initiative may be introduced in the near future. Exporters have also requested the government to prolong various schemes that assist them in managing working capital expenses and obtaining interest subsidies. While the interest equalization scheme concluded on December 31, 2024, other export support programs, such as the Remission of Duties and Taxes on Exported Products (RoDTEP), are set to expire on September 31.

The Impact

The primary focus for Indian businesses was the prompt dispatch of shipments awaiting release. Shipments destined for the US that were in progress as of April 9 were given priority, as they would not incur increased tariffs, according to Ajay Sahai, Director General & CEO of FIEO, who also mentioned that many subsequent orders are currently on hold.

However, the imposition of reciprocal tariffs raises additional concerns regarding the global economy. The volatility in international financial markets is expected to continue, and the manner in which countries will respond to these tariffs remains uncertain, as further cautioned.

A New Approach

Despite the 90-day suspension, experts including Dasgupta concur that relying solely on tariffs for competitive advantage is insufficient for India to effectively address this situation. It is imperative for India to reassess its manufacturing and export strategies to enhance domestic resilience, implement further reforms to facilitate business operations, attract investments, and adopt a more open approach in trade discussions.

Mithileshwar Thakur, the Secretary General of the Apparel Export Promotion Council, acknowledges that while reduced reciprocal tariffs on India provide a competitive advantage for the apparel sector, achieving scale in ready-made garments remains a significant challenge.

He also highlights that lower tariffs in major apparel-exporting countries such as Turkey and Brazil give them a competitive edge. A World Bank report published last year indicated that despite India’s rapid economic growth, the country’s trade in goods and services has diminished as a percentage of GDP, and its involvement in global value chains has decreased.

The report suggested that India should implement strategies to further reduce trade costs, lower trade barriers, and reassess free trade agreements and regional integration to meet the $1 trillion merchandise export goal. The government is cognizant of these issues and is actively pursuing various reform initiatives, including the much-anticipated deregulation proposal, as noted in the Economic Survey, which advocates for minimizing governmental interference in business operations.

Efforts are being made to reduce bureaucratic hurdles and compliance requirements for small enterprises while promoting a new wave of reforms by encouraging states to enhance land and labor regulations. According to TeamLease Regtech, India’s business environment is regulated by 1,536 acts and rules, 69,233 compliance requirements, and 6,618 filings.

Dasgupta concurs that additional measures are necessary to stimulate investments, particularly a stable policy framework that facilitates foreign direct investment. He remarks that while the concept of a single-window clearance has been discussed multiple times, it remains unfulfilled. Obstacles such as land and environmental clearances, electricity connections, and labor laws continue to hinder progress, and the enforcement of contracts poses further challenges for businesses.

Kathuria emphasizes the necessity of various domestic reforms, noting that while some, such as enhancing logistics competitiveness, may require time, others can be implemented swiftly. He states, ‘Reforms in trade facilitation, reducing regulatory burdens, and increasing the number of government officials to ease regulations can be achieved in the short term and will significantly benefit trade and industry.’

Sachin Chaturvedi, Director General of the Research and Information System for Developing Countries, asserts that India should concentrate on the cost, volume, and quality of production in sectors like electronics, pharmaceuticals, and textiles to enhance its export competitiveness. He also stresses the need for India to diversify its export markets by entering into more Free Trade Agreements (FTAs).

Chaturvedi highlights the significance of predictability and a rule-based order, stating, ‘India should target markets in Africa and Latin America for FTAs. Our FTAs must delve deeper than superficial matters to encompass a wide range of issues, including dispute resolution.’ The upcoming months are expected to be tumultuous for global markets and trade; however, this presents an opportunity for India to leverage America’s ‘Liberation Day’ to initiate a new phase of economic liberalization.

SECTORS BRACE FOR ‘LIBERATION’ JOLT

Bitter dose for Pharma?

Indian pharmaceutical exports have predominantly avoided the significant ‘reciprocal’ tariffs enacted by US President Donald Trump. The pharmaceutical sector has been granted exemptions from both the 10% universal baseline tariff and the more stringent 26% discounted tariff applicable to India. However, this exemption may not last long, as Trump has indicated the possibility of a reclassification of pharmaceuticals.

The Impact: An analysis of seven prominent Indian pharmaceutical firms, each facing 17–45% of their revenue linked to the US market, indicated that if tariffs were enacted and manufacturers absorbed 40% of the costs, EBITDA margins for FY27 could decrease by 1–2%. Firms like Aurobindo Pharma, Zydus Lifesciences, and Dr. Reddy’s Laboratories may experience considerable effects, while Divi’s Laboratories is anticipated to be minimally impacted.

Agriculture and Electronics

The imposition of tariffs on India’s agricultural and electronics exports may disrupt the current equilibrium, at least temporarily. The United States, being the largest economy globally, plays a significant role as an importer of essential agricultural products from India, such as seafood and rice. Recent data indicates that the US imported seafood from India valued at $2 billion in FY24, which constitutes approximately 2.5% of India’s total exports to the US.

In the electronics sector, India has recently increased its share of US imports; however, the majority of these products possess low to moderate value addition, rendering them susceptible to market fluctuations. In FY24, electronics represented 14.3% of total US imports from India, amounting to $11 billion.

The Consequences: According to the think tank GTRI, shrimp producers may face the most significant challenges if the proposed 26% tariff is implemented, potentially resulting in a 20% decline in wholesale market prices.

The Indian Cellular & Electronics Association asserts that despite the tariffs, India remains in a more advantageous position compared to its rivals, particularly China, Vietnam, Thailand, and Indonesia. Although this strategic edge is slightly less favourable than that of Brazil or Egypt, which stands at 10%, it still provides India with a crucial opportunity for export competitiveness in the near term.

Auto

The United States has enacted a 25% tariff on imported vehicles, set to commence on April 3. Global car manufacturers are bracing for potential job losses, increased prices, and disruptions in supply chains. According to the Society of Indian Automobile Manufacturers, domestic car producers are not expected to experience a major effect. However, auto parts manufacturers may face significant challenges due to this tariff. Analysts suggest that the 25% tariff could greatly affect the profit margins of auto parts manufacturers.

Steel

In the fiscal year 2024, India exported iron and steel valued at $475 million to the United States. Although the immediate effects are minimal, steel producers are concerned about potential dumping and pricing pressures in the international market. Analysts caution that Indian steel manufacturers may encounter difficulties as significant exporters such as China, Japan, and South Korea shift their steel exports away from the US in response to tariffs.