New Delhi: Nathan Anderson, the founder of Hindenburg Research, announced his intention to dissolve the firm, which has been instrumental in triggering significant short-selling by investors and prompting investigations by regulatory bodies. This activity has resulted in substantial losses in market capitalization for various companies, including India’s Adani Group and the US-based Nikola.

In a statement released on Wednesday, Anderson, who established Hindenburg in 2017, attributed his decision to the demanding and often overwhelming nature of the work.

He clarified in a letter, “There is not one specific thing — no particular threat, no health issue and no big personal issue.” Anderson expressed that the intensity of his focus on the firm has led to a neglect of other aspects of life and relationships that he values. He remarked, “I now view Hindenburg as a chapter in my life, not a central thing that defines me.”

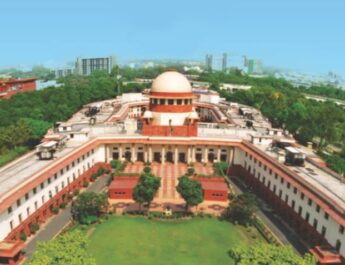

At the age of 40, Anderson gained significant attention in January 2023 when he released a report alleging that Gautam Adani’s Adani Group was involved in “pulling the largest con in corporate history.” At that time, Gautam Adani was recognized as the fourth-richest individual globally, according to the Bloomberg Billionaires Index.

Following this, Hindenburg also published reports concerning Dorsey’s Block Inc. and Icahn’s Icahn Enterprises. All three entities and their respective leaders have strongly contested the claims made by Hindenburg.

In previous statements, Gautam Adani asserted that the critical report from Hindenburg Research aimed not only to undermine the Adani group’s diverse business interests but also to tarnish the reputation of India’s governance practices.

Nonetheless, that year, the trio experienced a significant decline in their combined wealth, amounting to approximately $99 billion, while their publicly traded enterprises suffered a loss of up to $173 billion in market capitalization, as reported by Bloomberg.

Recently, Anderson targeted Ernie Garcia III’s Carvana Co., accusing him and his father, Ernie Garcia II, of engaging in a “historic accounting fraud.” The auto retailer swiftly rejected Hindenburg’s claims as “deliberately misleading and inaccurate.” Following this, the stock rebounded, increasing by over 5% this month.

Prior to his focus on short-selling, Anderson held several lesser-known positions on Wall Street and attempted to earn a living by providing tips to the Securities and Exchange Commission’s whistleblower program, in hopes of receiving financial rewards. However, he faced challenges in making a sustainable income.

What lies ahead for Nathan Anderson?

Anderson announced that he is concluding operations at his firm as of Wednesday, having worked through the final ideas and relayed information regarding suspected Ponzi schemes to regulatory authorities.

In the coming six months, he intends to create a series of videos and educational materials detailing Hindenburg’s investigative model, enabling others to understand the firm’s methodologies. “For the time being, my priority will be to ensure that every member of our team finds their next opportunity,” he stated.