RBI Monetary Policy Meeting LIVE:

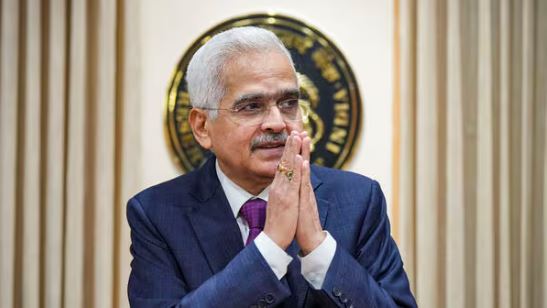

RBI Monetary Policy Meeting LIVE: The Reserve Bank of India (RBI) convened today, December 6, to announce its fifth bi-monthly monetary policy for the fiscal year 2025. The six-member Monetary Policy Committee (MPC), chaired by RBI Governor Shaktikanta Das, has opted to maintain the benchmark repo rate at 6.5% for the eleventh consecutive meeting, while also upholding a ‘Neutral’ stance on monetary policy. Additionally, the MPC has reduced the cash reserve ratio (CRR) by 50 basis points (bps) to 4%.

In a significant move, the RBI has decided to increase the interest rate ceilings on FCNR-B deposits, effective immediately, and has also raised the rates for FCNR deposits, as stated by Governor Das. This initiative is intended to enhance India’s appeal as a destination for foreign investments.

Following the announcement regarding the reduction of the cash reserve ratio (CRR) by 50 basis points (bps) to 4%, the benchmark indices of the Indian stock market, Sensex and Nifty 50, experienced a positive shift. The MPC, under the leadership of Governor Shaktikanta Das, has maintained the benchmark repo rate at 6.5% for the eleventh consecutive meeting, while continuing with a ‘Neutral’ monetary policy stance.